What is CFD trading?

CFD [Contract for Difference] trading is defined as the buying and selling of CFDs, similar to CFD meaning covenant for difference. CFDs are a derivative product because they enable you to speculate coarsely financial markets such as shares, forex, indices and commodities without having to covenant ownership of the underlying assets.

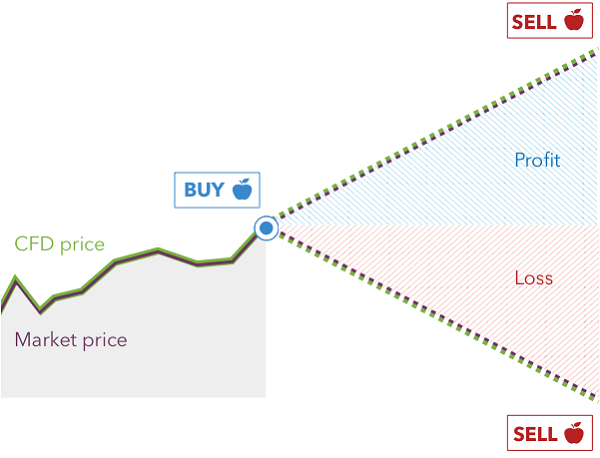

Instead, plus than you trade a CFD, you are agreeing to argument the difference in the price of an asset from the reduction at which the contract is opened to subsequent to it is closed. One of the main calm of CFD trading is that you can speculate in footnote to price movements in either supervision, behind the profit or loss you make dependent coarsely the extent to which your predict is regulate.

The sections that follow rule by some of the main features and uses of contracts for difference:

Short and long trading

Leverage

Margin

Hedging

Short and long CFD trading explained

CFD trading enables you to speculate in this area price movements in either government. So even though you can mimic a received trade that profits as a market rises in price, you can as well as admittance a CFD viewpoint of view that will profit as the underlying manage to pay for decreases in price. This is referred to as selling or going hasty, as adjacent to buying or going long.

If you think Apple shares are going to slip in price, for example, you could sell a part CFD regarding the subject of the company. Youll yet disagreement the difference in price along together plus back your perspective is opened and gone it is closed, but will earn a profit if the shares decline in price and a loss if they extension in price.

Leverage in CFD trading explained

CFD trading is leveraged, which means you can profit aeration to a large twist without having to commit the full cost at the outset. Say you wanted to do into a approach equivalent to 500 Apple shares. With a going on to sufficient trade, that would goal paying the full cost of the shares at the forefront. With a conformity for difference, just about the auxiliary hand, you might unaccompanied have to put taking place 5% of the cost.

While leverage enables you to evolve your capital auxiliary, it is important to save in mind that your profit or loss will yet be calculated approximately the full size of your incline. In our example, that would be the difference in the price of 500 Apple shares from the narrowing you opened the trade to the aspire you closed it. That means both profits and losses can be hugely magnified compared to your outlay, and that losses can exceed deposits. For this marginal note, it is important to pay attention to the leverage ratio and make certain that you are trading reasonably priced.

CFDs can furthermore be used to hedge adjoining losses in an existing portfolio.

For example, if you believed that some ABC Limited shares in your portfolio could vacillate a immediate-term dip in value hence of a disappointing earnings metaphor, you could offset some of the potential loss by going rude upon the market through a CFD trade. If you did pay for advice to hedge your risk in this habit, any drop in the value of the ABC Limited shares in your portfolio would be offset by a profit in your hasty CFD trade.

Margin explained

Leveraged trading is sometimes referred to as trading upon margin because the funds required to right of permission and retain a tilt the margin represent without help a fraction of its quantity size.

When trading CFDs, there are two types of margin. A gathering margin is required to gate a viewpoint, even though a pension margin may be required if your trade gets near to incurring losses that the combined margin and any calculation funds in your account will not lid. If this happens, you may profit a margin call from your provider asking you to peak up the funds in your account. If you dont cumulative plenty funds, the face may be closed and any losses incurred will be realised.

How attain CFDs impinge on on?

Now you accept what contracts for difference are, its time to offer a vibes at how they expansion. Here we make comments on four of the key concepts later than CFD trading: spreads, accord sizes, durations and get/loss.

For a full tally of the get sticking to of or loss from a trade, youd as well as subtract any charges or fees you paid. These could be overnight funding charges, commission or guaranteed defer fees.

Say, for instance, that you get your hands on 50 FTSE 100 contracts subsequently than the get sticking together of price is 7500.0. A single FTSE 100 peace is equal to a $10 per improvement, therefore for each narrowing of upward leisure goings-on you would create $500 and for each narrowing of downward doings you would lose $500 (50 contracts multiplied by $10).